In December 2018 the retirement body changed its rules to allow subscribers to withdraw up to. From the earlier announcement eligible members with savings of RM90000 and below can withdraw up to RM9000 as an advance provided theres RM100 remaining in Account 1 at all times.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Chief EPF officer Tunku Alizakri Alias said the fund aimed to allow for the application for the additional withdrawal facility to proceed in January 2021.

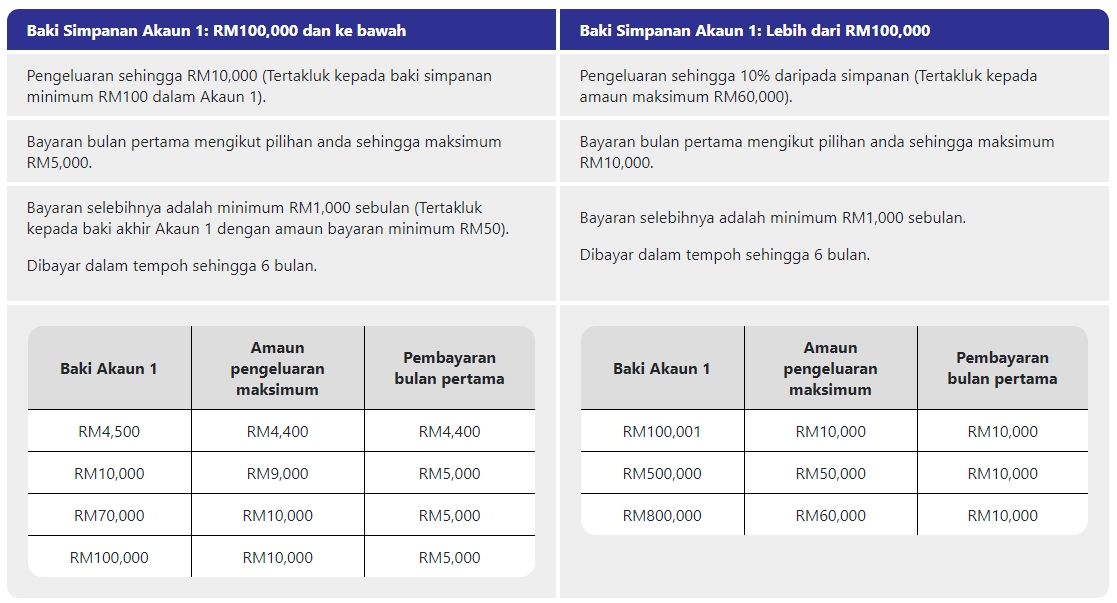

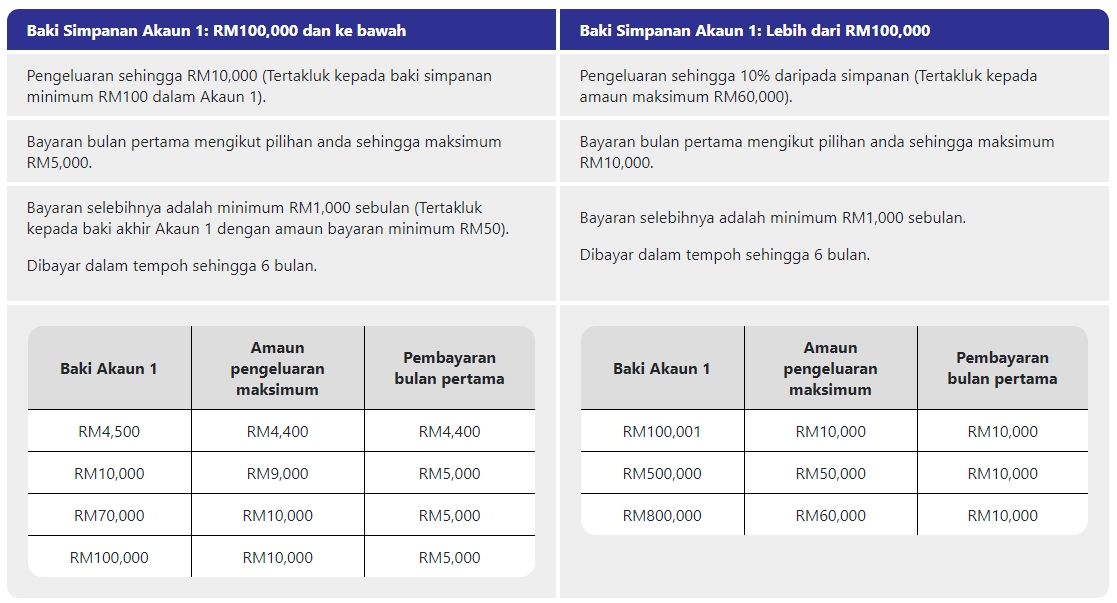

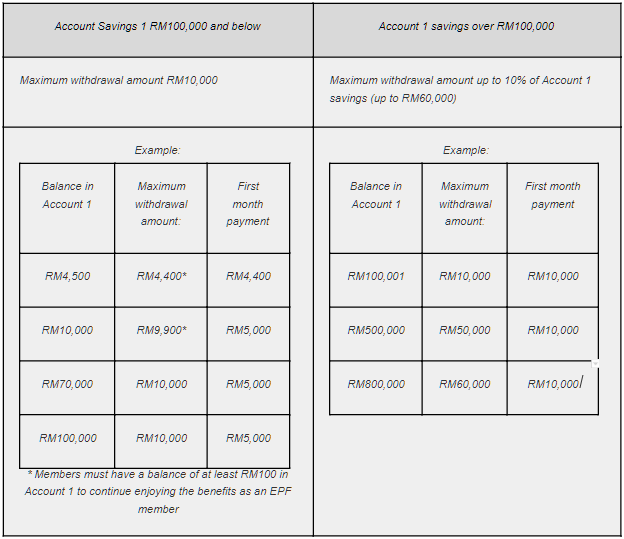

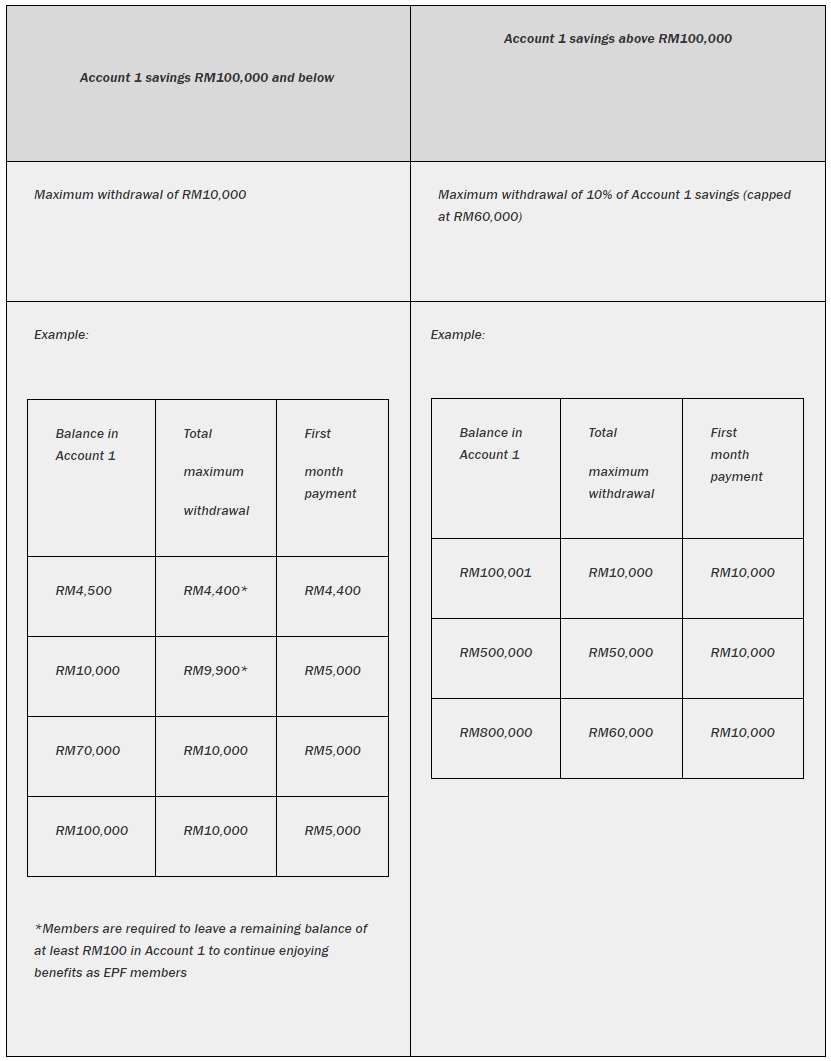

Epf withdrawal account 1 in dinar. EPF widens i-Sinar eligibility can withdraw up to 10 pct from Account 1. The Employees Provident Fund EPF is the sole mandatory retirement saving. For members with RM100000 or less in Account 1 you are eligible to withdraw up to RM10000 while maintaining a minimum of RM100 balance.

When a person migrate to another country. This individual can cease to contribute to the EPF because they are entitled for the government pension scheme under KWAP. One mobile number can be used for one registration only.

Application for the Employees Provident Fund EPF i-Sinar facility is now open for individuals who fall under Category 1. We had a dip when no conditions were imposed on Account 1 in February and people took out a big chunk in the beginning. More than 8 million members will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programme.

This whole idea of withdrawing from Account 1 is a bad idea. The Pros and Cons Updated 28 Dec 2020 By Faiz Rahim Nisya Aziz Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 -. For the first payout you can get up.

Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. The facility of passbook is not available for members of. It became more problematic when access was given to Account 1 as opposed to Account 2.

This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19 pandemic helping them sustain their livelihood. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online.

KUALA LUMPURThe Employees Provident Fund EPF will provide further details on the targeted EPF Account 1 withdrawal facility on Nov 11. Tap into your inner strength and discover your talents. The idea is that this will help those who have been impacted by the prolonged pandemic to make ends meet.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually. Step 2 Then input your UAN your password and the Captcha to sign in. Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000.

The withdrawal amount will vary depending on each members needs and of course their available balance. Starting from today eligible members can visit the official i-Sinar website to apply online. The i-Lestari withdrawals were introduced last year to help people ride out the tough times giving members access to Account 2.

The Employees Provident Fund EPF has widened the access to Account 1 under the i-Sinar facility now covering active members who have lost their jobs given no-pay leave or have no other source of income. However bear in mind that the EPF savings especially Account 1 is basically meant for retirement or when one reaches the age of 50 where part of the Account 1 money can be withdrawn. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December.

As explained earlier by the EPF applicants who. This is the main account for. Some two million eligible contributors can now withdraw between RM9000 and RM60000 from Account 1 in the Employees Provident Fund EPF under i-Sinar.

KUALA LUMPUR Nov 8. A Member of Parliament MP has proposed that members of the Employees Provident Fund EPF who are having trouble paying the cost of healthcare be allowed to make withdrawals from Account 1. As per the entity the claim under the pandemic advance facility is processed within 3 days post which a cheque is.

Making partial withdrawal and full withdrawal from employee provident fund EPF has become simpler and faster due to the rule changes by the Employees Provident Fund Organisation EPFOSubscribers can now make partial withdrawal requests from their EPF account online. EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. The maximum amount that you can take out from Account 1 depends on your current balance.

A member can view the passbooks of the EPF accounts which has been tagged with UAN. If you do decide to withdraw from your EPF Account 1 be sure to work out a plan to replenish the amount you have taken instead of just waiting for future salary deductions to do the job. For those who have above RM100000 in Account 1 they can withdraw a maximum 10 of their Account 1 savings up to RM60000 whichever is lower.

You can withdraw up to RM10000 in the first month. A civil servant placed under the pension scheme. The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1.

Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. According to the PF withdrawal guidelines if the EPFPF account is linked to a PAN the TDS rate will be 10 but if the EPF account is not linked to a PAN the TDS rate would be 20. EPF Account 1 Withdrawal i-Sinar.

The Employees Provident Fund EPF will place all contributions into Account 1 in order to replenish the savings of its members who. For those with RM100000 and below in Account 1 they can withdraw any amount up to RM10000. Time taken to process withdrawal claim.

Upon a person becoming disable or in the event of death.

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar How To Withdraw Money From Account 1 And What Are The Requirements

Tidak ada komentar:

Posting Komentar