For this lower eligibility members will be able to take out a maximum of RM10000. KUALA LUMPUR Dec 2.

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

For those with more than RM90000 in Account 1 are able to withdraw a maximum of 10 of their Account 1 savings with a maximum cap of RM60000.

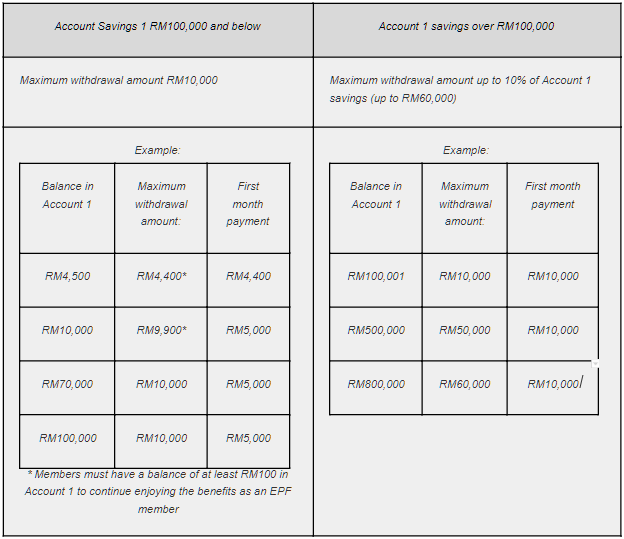

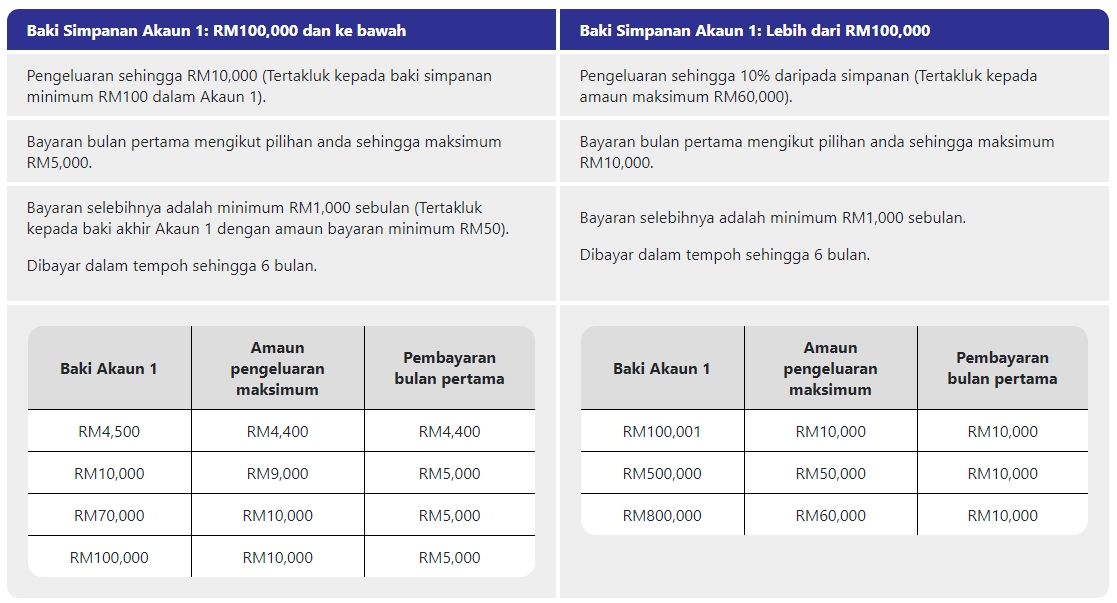

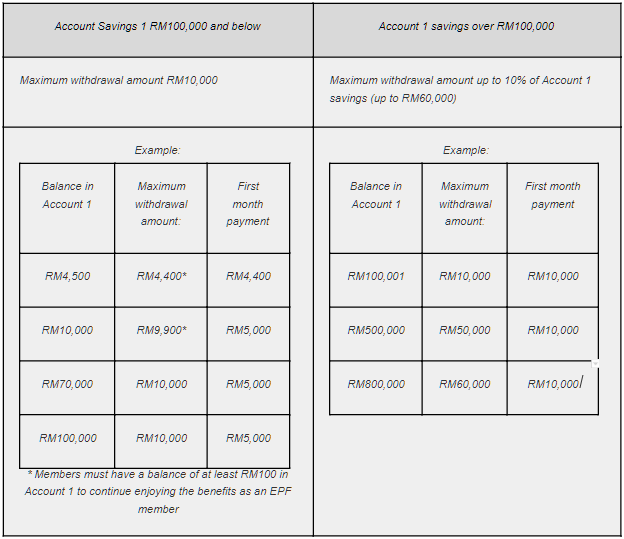

Epf withdrawal account 1 rm10000. The coalition had on November 10 list two conditions where it wanted the government to raise the withdrawal limit for Account One in the EPF to RM10000 and for a blanket extension of the loan moratorium until next June. The Employees Provident Fund EPF now allows contributors with Account 1 savings of not more than RM100000 to withdraw up to RM10000 under its expanded i-Sinar facility with the payments to be staggered over a maximum period of six months. KUALA LUMPUR Nov 3.

Bernama pic October 26 2020 KUALA LUMPUR In light of requests by some Malaysians for a one-off EPF withdrawal of up to RM10000 former prime minister Datuk Seri Najib Razak is of the view that it can be considered with conditions. A civil servant placed under the pension scheme. KUALA LUMPUR Nov 3.

Govt okays RM10000 withdrawal from EPF Account 1. EPF members with less than RM100000 in Account 1 can withdraw up to RM10000 under expanded i-Sinar facility. The government will allow all Employees Provident Fund EPF contributors to withdraw up to RM10000 from their EPF Account 1 through i-Sinar said Finance Minister Tengku Zafrul Aziz said in Dewan Rakyat today.

The Employees Provident Funds EPF withdrawal facilities which saw a total of RM101 billion being disbursed to over 74 million members so far was among the issues raised in Dewan Rakyat on WednesdayDatuk Dr Xavier Jayakumar Independent-Kuala Langat said the withdrawal had caused members to have less than RM10000 in their EPF accounts. The payments will also be disbursed in stages over a maximum of six. EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions.

Members with more than RM100000 in their EPF account can withdraw up to 10 of their savings in Account 1 capped at RM60000. The Employees Provident Funds EPF withdrawal facilities which saw a total of RM101 billion being disbursed to over 74 million members so far was among the issues raised in Dewan Rakyat on Wednesday. Allow those who have lost their jobs or suffered pay cuts to withdraw up to RM10000 from.

Upon a person becoming disable or in the event of death. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. KUALA LUMPUR Dec 2.

Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 - you can check via i-Account. With the announcement i-Sinar will benefit 2 million eligible members and result in a total. According to Umno Youth many people in the T20 high income group and M40 middle income group have been relegated to the B40 low income group.

The first payment can be as much as RM5000Meanwhile those who have more than RM100000 savings in Account 1 can. The Employees Provident Fund EPF now allows contributors with Account 1 savings of not more than RM100000 to withdraw up to RM10000 under its expanded i-Sinar facility with the payments to be staggered over a maximum period of six months. I-Sinar 8 Other Things You Can Use Your EPF for.

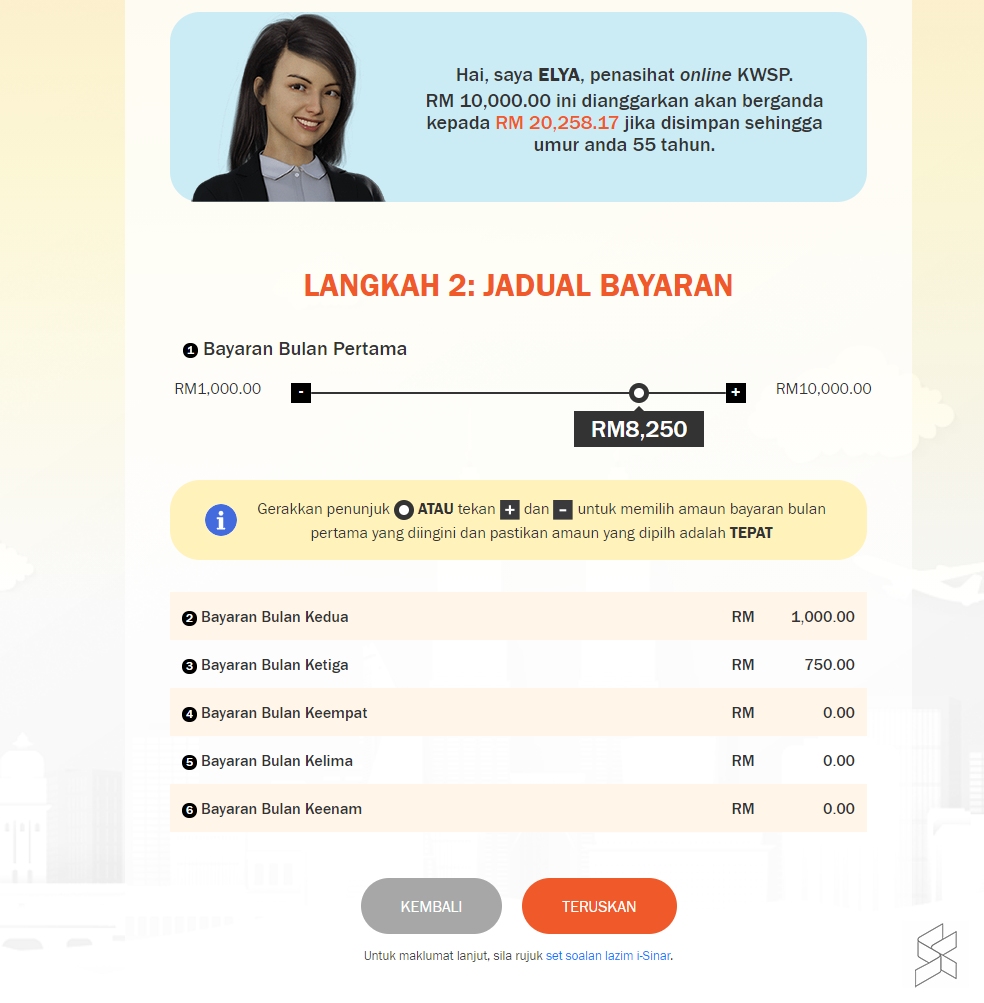

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. For members with Account 1 savings balance of RM100000 or less you can only withdraw up to a maximum of RM10000 and it will be staggered across 6 months. KUALA LUMPUR Dec 2.

Datuk Dr Xavier Jayakumar Independent-Kuala Langat said the withdrawal had caused members to have less than RM10000 in. Anyway coming back to the withdrawal there are plenty of. In March Prime Minister Tan Sri Muhyiddin Yassin announced that EPF contributors would be allowed to withdraw up to RM500 a month.

When a person migrate to another country. Expanded coverage and maximum withdrawal amount of up to rm10000 and rm60000 from account 1 Application begins from mid-December 2020 KUALA LUMPUR 26 November 2020. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021.

This individual can cease to contribute to the EPF because they are entitled for the government pension scheme under KWAP. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. He personally said contributors may apply to withdraw their funds online or even visit any EPF office.

10000-Member is not eligible savings in Account 1 is less than the new. This is the main account for. Step 2 Then input your UAN your password and the Captcha to sign in.

Members with more than RM100000 in their EPF account can withdraw up to 10 of their savings in Account 1 capped at RM60000. The Employees Provident Fund EPF will be announcing the details of i-Sinar early next week following the announcement by Minister of Finance Tengku Datuk Seri Zafrul Tengku Abdul Aziz. Umno Youth also visited the EPF Board in September to request the implementation of an enhanced i-Citra withdrawal scheme that would allow members to withdraw up to RM10000 from their EPF accounts.

KUALA LUMPUR Dec 2. The Employees Provident Fund EPF now allows contributors with Account 1 savings of not more than RM100000 to withdraw up to RM10000. If you want to know what else you can do with your EPF monies read.

EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. EPF members with less than RM100000 in Account 1 can withdraw up to RM10000 under expanded i-Sinar facility. The Employees Provident Fund EPF will place all contributions into Account 1 in order to replenish the savings of its members who.

The payments will also be disbursed in stages over a maximum of six months with the first payment amounting to a maximum of RM10000. Once approved you can receive up to RM5000 for the first payout and it will be credited. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal.

The Employees Provident Fund EPF now allows contributors with Account 1 savings of not more than RM100000 to withdraw up to RM10000 under its expanded i-Sinar facility with the payments to be staggered over a.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

All Contributors To Epf Can Now Apply To Withdraw Up To Rm10 000 Says Finance Minister Malaysia Malay Mail

Epf I Sinar Applications Are Now Open Here S How To Apply Soyacincau

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

You Can Withdraw Rm10 000 From Epf Account 1 If You Have Rm100 000 Or Less

Tidak ada komentar:

Posting Komentar