YOURSAY Account 1 EPF withdrawal will later affect those in old age. Employees who ceases to be EPSpension member will get Employers 833 contribution in PF.

Kwsp Epf Partial Withdrawal Age 50

Malaysians can withdraw their EPF fund when they reach fifty 50 years old from Account 2.

Epf withdrawal age 50 account 1. Commissioner in charge of. An employee can withdraw up to 50 of his PF amount from his EPF account. 3 times in the entire career A salaried person can withdraw from EPF account for the purpose of house renovation or alteration if a person has.

For this one has to submit Form 10D along with the Composite Claim Form. 90 of the EPF balance can be withdrawn after the age of 54 years. Asked on Sep 7 2010 at 2115 by.

Up to 90 of hisher EPF amount. Additional forms documents required. This individual can cease to contribute to the EPF because they are.

Please DO NOT refer to the submission information in Employees Provident Fund KWSP website. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Details on Malaysias EPF KWSP Account 1 VS Account 2 withdrawals.

Early Retirement Once you reach 57 years of age you can opt for early retirement and withdraw up to 90 of the balance including the interest. As per EPF withdrawal rules a salaried employee can withdraw from a provident fund account on two counts. Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 - you can check via i-Account.

No minimum service tenure. Partial withdrawal before retirement NA 68NN After 54 years of age and within one year of retirement superannuation 90 of amount in PF of the member 1 one NA Member. 21 - In case the PF amount is not settled within 20 days to whom the matter is to be reported.

If you want to know what else you can do with your EPF monies read. Documents required for PF withdrawal. Have attained at least 50 years of age to withdraw from the EPS pension at a lower rate.

The Employees Provident Fund Contribution should be paid till the date of his leaving the service irrespective of the age of the member. Upon a person becoming disable or in the event of death. How to withdraw EPF money Malaysia.

Based on the average life expectancy of. As per the EPS pension scheme an employer can provide different kinds of pensions to the employees. Withdrawing PF balance and reduced pension age 50-58 over ten years of service You can only get a pension after turning 50 years of age and have rendered at least 10 years of service.

I will be 50 soon. Up to 50 from the EPF account. A blank and cancelled.

When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2. I-Sinar 8 Other Things You Can Use Your EPF for. 2What is the best way to.

As per EPS rules if any member has completed less than 10 years of service on the date of exit date on which the member leaves the job in the organisation or has attained the age of 58 years whichever is earlier then the individual is eligible for lump-sum withdrawal from the EPS account. YOURSAY Something must be sacrificed by EPF to allow. 992 Views Asked 11 Years Ago.

The documents required to withdraw money from your PF account are listed below. There are also different withdrawal rights according to the various EPF accounts Akaun 1 and Akaun 2. One year before retirement.

01 May 2021. If you keep your non-contributory EPF accounts for more than 10 years then EPFO will move. EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions.

If your service period has more than 10 years and you are between the age of 50 and 58 you may opt for a reduced pension. Dec 11 2020 1200 AM. If such an individual is less than 58 years.

1 One No Second advance before 3 years from first Member Certificate in Certificate F from Doctor. Medical expensesNatural Calamitypurchase of equipment by physically handicappedclosure of factorycut in electricity in establishment. Should be above 54 years of age.

Delay withdrawing the pension for by 2 years ie till he or she is 60 years to become eligible to get EPS pension at a rate of 4 annually. How To Withdraw EPF Money Reaching 50 Years Old. Different EPS and EPF pension types.

EPF withdrawal at age 50. BERNAMA reported that more than 50 137000 out of 245000 of the 54-year-old EPF contributors held less than RM50000 in their EPF savings to cover their retirement. As the EPF places the health of members and staff as its top priority it would enforce strict conditions for the identified branches which include among others to limit the exposure of members and staff at all times only simple and fast transactions requiring no physical contact ie.

Siblings and children provided that one has completed a minimum of seven years of service to withdraw 50 of the contribution. You can only make a one-time partial withdrawal of all or part of your savings in Account 2 when you reach age 50 to help you take the necessary steps in planning for retirement. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment.

I have a BSN account which has not been active for a while. Anyway coming back to the withdrawal there are plenty of. A civil servant placed under the pension scheme.

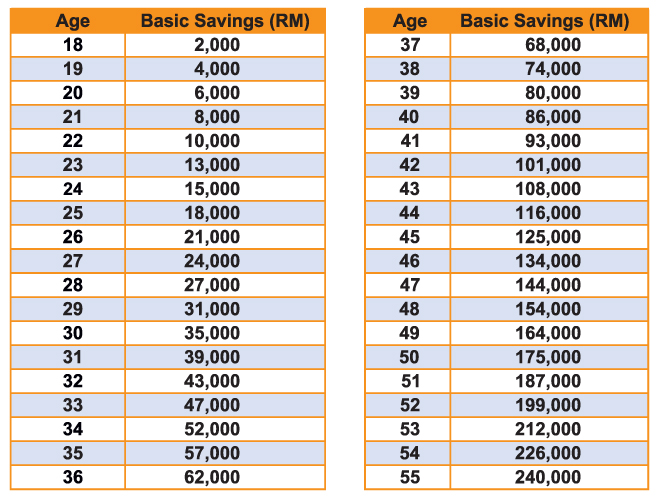

When a person migrate to another country. More alarmingly about a total of 43 538 million members under the age of 55 showed savings of less than RM10000 in their Account 1. Withdrawal within one year before retirement.

The other conditions include i The property needs to be registered in the name of the employee or spouse or both ii Withdrawal is permitted subject to providing necessary documents as required by the EPFO for the home loan availed iii The corpus in the members PF account or together with the spouse along with interest has to be over Rs 20000 make sure to check EPF balance before. Here are some pension types. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

Form 10C and Form 10D. One can withdraw the advance amount from their PF. Here are the main amendments to EPF withdrawal rules-.

However such interest is taxable. He can approach the Regional PF. Up to 6 months of hisher basic and DA the entire contribution.

Age 505560 withdrawals and mobile iAkaun activation services will be available at branches. You can make up to 3 withdrawals from these criteria. I intend to bank into this account 1Can the banks which I owe money freeze my BSN account.

I owe several banks cc loan and some are in legal stages but not bankruptcy stage yet. From the date of non-contributory EPF to the time of withdrawal you are eligible to earn the interest. Your account will turn inactive only when you reach the age of 58 years and not withdraw the EPF balance Earlier it was 3 years from the non-contributory period.

Information is for general reference only is an unofficial summary based on EPFs official website. The 15 different categories of withdrawals have been divided into Account 1 only Account 2 only both accounts withdrawals.

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Epf Withdrawal Taxation New Tds Tax Deducted At Source Rules

Epf Withdrawals For Those Aged 50 55 And 60 I Akaun Activation To Resume Wednesday Malaysia Malay Mail

Tidak ada komentar:

Posting Komentar