A member can view the passbooks of the EPF accounts which has been tagged with UAN. We show you how to.

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Employees should however ensure that their contact number used to activate UAN is operational.

Epf withdrawal. When you count on EPF Withdrawal online you unlock numerous benefits including. Of India on the third anniversary of UMANG App EPFO invites. As already mentioned if the employee has seeded hisher Aadhaar card details with ones UAN account they do not require the attestation of their employer to make a PF withdrawal.

Before 1 year of retirement. This limit was raised in the budget of 2016. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab.

Following are the PF withdrawal rules for withdrawing the corpus before five years of continuous service. Chief EPF Officer Alizakri Alias said i-Lestari will provide some relief to those financially affected during this period of concern and uncertainty. While it is possible to withdraw the EPF corpus before retirement it is still advised that you do not do so.

EPF Withdrawal Online - Individuals can benefit from the convenience of the withdrawal process of PF online. Hence withdraw only if it is an emergency. One mobile number can be used for one registration only.

Want an advance from my Provident Fund Account. While in case of partial withdrawal it can be done for reasons like medical need home loan repayment marriage education among others. Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online.

Says that EPF members may apply for the i-Lestari Account 2 Withdrawal Scheme beginning 1 April 2020. Before 5 Years of Service. Employees can make a PF withdrawal claim on the EPFO member portal by following the steps mentioned below.

If youre 58 years or more and retired you can withdraw the entire amount from your EPF corpora. KUALA LUMPUR Nov 8. The i-Citra withdrawal facility is open to all EPF members aged 55 years old and below.

According to the EPF the first payment is expected to be credited into the respective member bank accounts in August 2021. EPF Withdrawal before 5 years of Service. EPFO has allowed its members to avail the second COVID-19 advance from their PF account.

Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. Hassle-free and seamless EPF Withdrawal- When you rely on the online process for the EPF withdrawal claim you save time and efforts that would have been misspent in making multiple PF office visits and in standing prolonged queues.

EPF withdrawal is also possible if an employee leaves the job and stays unemployed for at least two months. An employee can withdraw up to 50 of his PF amount from his EPF account. About Employees Provident Fund Organisation.

EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. When The Tax Is Applicable. However for that make sure youve served for 10 service years.

This is the most known reason for EPF withdrawal. A Member of Parliament MP has proposed that members of the Employees Provident Fund EPF who are having trouble paying the cost of healthcare be allowed to make withdrawals from Account 1. You can make up to 3 withdrawals from these criteria.

Visit the EPFO member portal. Employee Provident Fund investments focus on saving towards retirement. One can withdraw the advance amount from their PF.

Please Apply for an Advance Withdrawal through COMPOSITE CLAIM FORM Aadhar 1MB Instructions 6927KB COMPOSITE CLAIM FORM Non-Aadhar 955KB Instructions 7695KB Annexures to be attached with the claim form for withdrawal under para 68-BD of EPF Scheme 1952. Benefits of EPF Withdrawal Online. A person can withdraw the complete EPF balance if heshe retires or is unemployed for more than two months.

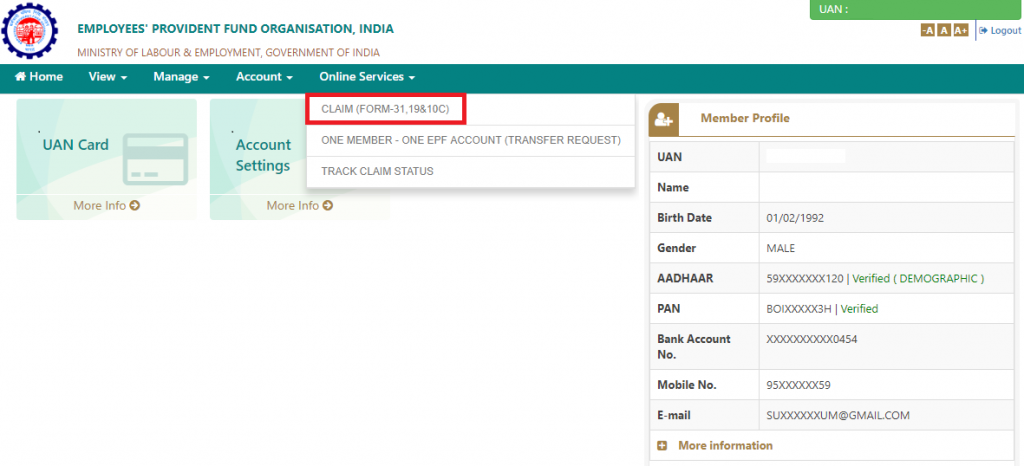

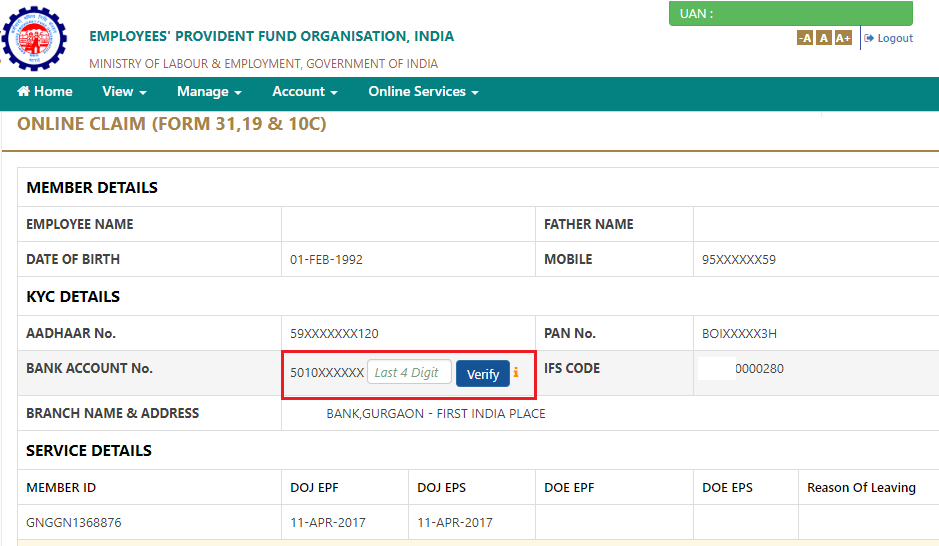

The i-Citra withdrawal facility was introduced following the announcement of the National Peoples Well-Being and Economic Recovery Package PEMULIH by Prime Minister Tan Sri Muhyiddin Yassin on June 28 2021 as a temporary relief measure to help EPF. If you want to know how to withdraw money from EPF this article can help you understand the process. Step 2 Then input your UAN your password and the Captcha to sign in.

The EPF organization has updated the withdrawal rule of EPF Balance which is an employee cant withdraw 100 corpus before retirement at any situation. In case you want to withdraw your funds before 5 years of service you should keep the following EPF withdrawal rules in mind-. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

However if the withdrawal amount is less than 50000 no TDS is deducted. Lanang MP proposes withdrawal from EPF Account 1 to cover medical costs. These EPF withdrawal rules are stated under section 192A Finance Act of 2015.

An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. Self Reliance with Integrity Deadline for Aadhaar linking of UAN extended till 31122021 for Establishments in NORTH EAST and certain class of establishments EPFO won the Platinum Award the highest award given by Honble Minister Information Technology Govt. Procedure for EPF withdrawal online.

Even if you have resigned or are going through unemployment situation then also cant withdraw 100 balance from the EPF account. However if the withdrawal amount is less than 50000 no TDS is deducted. The maximum withdrawal amount permitted is RM5000 and it will be disbursed up to 5 months.

Steps for EPF Withdrawal Online. In case you want to withdraw your funds before 5 years of service you should keep the following EPF withdrawal rules in mind. Alice Lau Kiong Yieng PH-Lanang said that the move could.

It is available for citizens non-citizens and permanent residents. According to the act your EPF withdrawal is bound to attract a Tax Deducted on Source TDS if you have withdrawn an amount of more than 50000 and have worked for a period of 5 years or less. They can expect their savings to be deposited into their bank accounts from 1 May 2020.

EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. Here is a step-by-step guide to withdraw the amount. Before you can withdraw money from EPF online there are two things you must ensure.

EPF Withdrawal Rules 2021. Independent India 75. To be eligible you must have a minimum of RM150 in your EPF account on the day of application.

Pf Withdrawal Form Know Epf Withdrawal Procedure

Pf Money Withdrawal Step By Step Guide To Do It Online Provident News India Tv

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

How To Withdraw Epf And Eps Online Basunivesh

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Tidak ada komentar:

Posting Komentar