Online filing of transfer claim from previous account to new EPF account in case of job change from one covered EPF establishment to another EPF Covered establishment. Employees Provident Fund can be withdrawn by the employee in either of the below cases-At the time of retirement On or after 58 years of age If unemployed for two months of time.

New Epf Withdrawal Forms Withdraw Without Employer Signature Basunivesh

Otherwise withdraw the EPF balance immediately after 2 months from the non-contributory period or unemployment.

Epf withdrawal from 1st account. If you still not respond and not withdraw then they move to SCWF. The maximum amount that you can take out from Account 1 depends on your current balance. For those who have above RM100000 in Account 1 they can withdraw a maximum 10 of their Account 1 savings up to RM60000 whichever is.

If an employee remains unemployed for more than two months then he can withdraw 100. Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 - you can check via i-Account. EPF can be withdrawn under these cases.

When can I Withdraw from the EPF Account. I-Sinar 8 Other Things You Can Use Your EPF for. Member can effect transfer of EPF Fund from previous account to new account without transfer claim if both account is linked with UAN and Aadhar seeded.

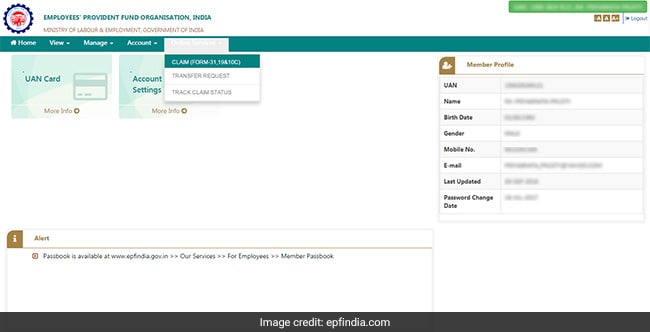

Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online. With the announcement i-Sinar will benefit 2 million eligible members and result in a total. However there are various EPF withdrawal rules that one needs to adhere to in order to make withdrawals from the PF account.

- Permanent Resident or non-Malaysian who was a member of the EPF prior to the 1st of August 1998 - Under the age of. The provision to withdraw money from EPF accounts was first announced last year in March 2020 under the Pradhan Mantri Garib Kalyan Yojana. From the date of non-contributory EPF to the time of withdrawal you are eligible to.

Anyway coming back to the withdrawal there are plenty of. The approved withdrawal amount will be paid for a period of up to five months with a fixed monthly payment of RM1000 per month subject to. Your account will turn inactive only when you reach the age of 58 years and not withdraw the EPF balance Earlier it was 3 years from the non-contributory period.

A member can view the passbooks of the EPF accounts which has been tagged with UAN. What is the process for EPF withdrawal. You can get the form from the EPF portal and print out and fill the physical application.

Hence considering all these rules it is always best to transfer your old EPF accounts to the existing active EPF account immediately. Death before the specified retirement age. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less.

Apart from the obvious interest-free access to cash. In December 2018 the retirement body changed its rules to allow subscribers to withdraw up to 75 of the cumulative EPF corpus after leaving a job within one month. From the earlier announcement eligible members with savings of RM90000 and below can withdraw up to RM9000 as an advance provided theres RM100 remaining in Account 1 at all times.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. When you retire. If you want to know what else you can do with your EPF monies read.

Upon a person becoming disable or in the event of death. The benefits of withdrawing from your EPF Account to purchase a house. A civil servant placed under the pension scheme.

Based on the changes of EPFO ITAT and SCWF we can conclude as below for the simplicity. Once approved you can receive up to RM5000 for the first payout and it will be credited the following month after submission and approval. Partial withdrawal from the EPF account can be made under a few circumstances.

EPF withdrawal with a physical application. Its chief executive officer CEO Datuk Seri Amir Hamzah Azizan said all members below the age of 55 are eligible to apply for i-Citra which would allow them to withdraw up to a maximum of RM5000 subject to their total combined balance in both Accounts 1 and 2. When a person migrate to another country.

EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. Its chief executive officer CEO Datuk Seri Amir Hamzah Azizan said all members below the age of 55 are eligible to apply for i-Citra which allows them to withdraw up to a maximum of RM5000 subject to their total combined balance in both Account 1 and 2. There are also different withdrawal rights according to the various EPF accounts Akaun 1 and Akaun 2.

When you are unemployed for over two months. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. One mobile number can be used for one registration only.

Lanang MP proposes withdrawal from EPF Account 1 to cover medical costs. To able to draw money from your EPF fund you can do one of the following. How much can you withdraw.

KUALA LUMPUR Nov 8. The approved withdrawal amount will be paid for a period of up to five months with a fixed monthly payment of RM1000 per. An individual must be 57 years old to withdraw up to 90 of the amount of his PF account Earlier the age limit was 54 years.

Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000. Submit a physical application for EPF withdrawal. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021.

An individual can choose to withdraw from their EPF account for various reasons such as settling down in a foreign country or premature retirement as a result of any physical or mental disability. For those with RM100000 and below in Account 1 they can withdraw any amount up to RM10000. For members with Account 1 savings balance of RM100000 or less you can only withdraw up to a maximum of RM10000 and it will be staggered across 6 months.

In order to make the withdrawal you have to get an attestation from a gazetted office. Modified Declaration form Form No-11 for automatic transfer of Funds. Follow the EPF withdrawal online procedure.

A Member of Parliament MP has proposed that members of the Employees Provident Fund EPF who are having trouble paying the cost of healthcare be.

How To Withdraw A Full Epf Amount Quora

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawals New Rules Provisions Related To Tds

Online Epf Withdrawal How To Do It In Five Steps

Tidak ada komentar:

Posting Komentar