KUALA LUMPUR Nov 8. EPF Account 1 Withdrawal i-Sinar.

At the age of 54 years.

Epf withdrawal account 1 age. The Pros and Cons. Employees Provident Fund EPF withdrawal was not an option unless one has reached the age of 50 or other reasons that would generate future economic benefits as outlined by EPF to withdraw the amount in Account 2 and 55 years old for Account 1. One can withdraw the advance amount from their PF.

Sharing the notification image for your benefit also. Your account will turn inactive only when you reach the age of 58 years and not withdraw the EPF balance Earlier it was 3 years from the non-contributory period. It therefore matures when the employee attains 58 years of age.

90 of the EPF balance can be withdrawn after the age of 54 years. A Member of Parliament MP has proposed that members of the Employees Provident Fund EPF who are having trouble paying the cost of healthcare be allowed to make withdrawals from Account 1. KUALA LUMPUR 26 June 2020.

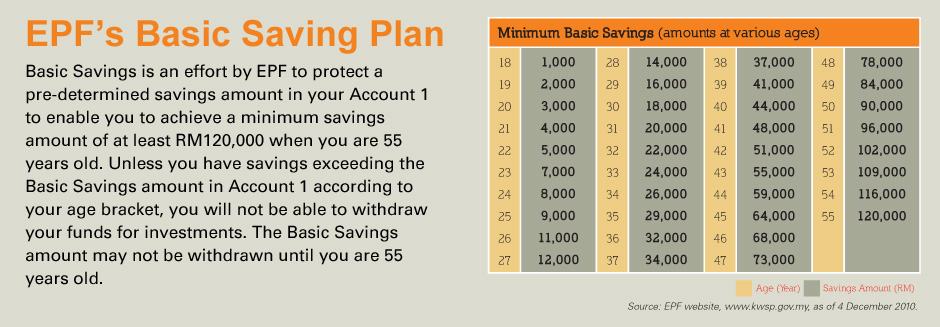

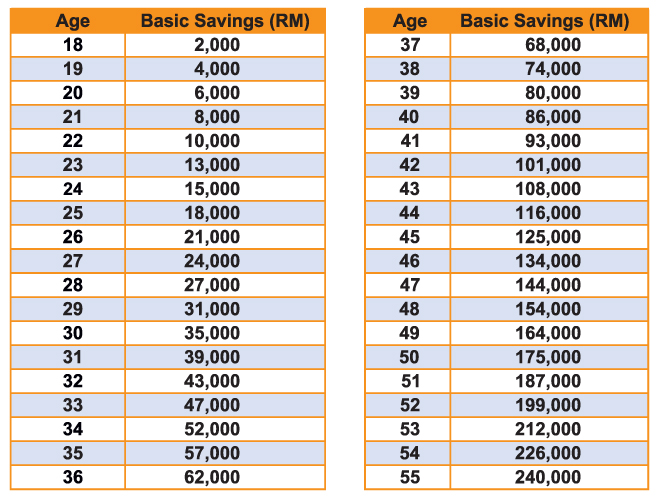

Basic Saving Amount Table Basic Savings is an amount of savings to be put aside in Account 1 progressively at various pre-determined age levels so as to enable a member to accumulate a minimum savings of RM120000 at age 55 years. You can withdraw 90 of EPF balance once you reach the age of 57 years. The Employees Provident Fund EPF takes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65.

From the date of non-contributory EPF to the time of withdrawal you are eligible to. EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old. Members cannot access savings in Akaun Emas until they reach age 60.

Although the EPF corpus can be withdrawn only after retirement early retirement is not considered until the person reaches 55 years of age. Hence EPFO will pay you the interest up to the age of 58 years Retirement age3 Yrs. An employee can withdraw up to 50 of his PF amount from his EPF account.

The Employees Provident Fund EPF Scheme aims to create a retirement corpus for the employee over his active working years. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. The Employees Provident Fund EPF is the sole mandatory retirement saving.

Even before the government allowed Account 1 withdrawals there were those who reckoned that the government should shift the withdrawal age higher from age 55 since the retirement age has gone up so that retirement savings can last longer. Modified Declaration form Form No-11 for automatic transfer of Funds. You can make up to 3 withdrawals from these criteria.

An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. To meet short-term needs partial early withdrawal from EPF is permitted on certain conditions but to withdraw the full corpus the subscriber must be. This is an account for EPF members who continue to work beyond the age of 55.

I-Sinar 8 Other. Based on the changes of EPFO ITAT and SCWF we can conclude as below for the simplicity. However bear in mind that the EPF savings especially Account 1 is basically meant for retirement or when one reaches the age of 50 where part of the Account 1 money can be withdrawn.

FULL WITHDRAWAL AT AGE 55 REMAINS. Withdrawal from account 1 of Employees Provident Fund accounts was previously off limits to the members until the retirement age of 60. Deputy Finance Minister I Mohd Shahar Abdullah says it is estimated only 27 of active EPF members have savings in Account 1 that exceed the basic savings quantum based on age following i-Sinar and i-Citra withdrawals.

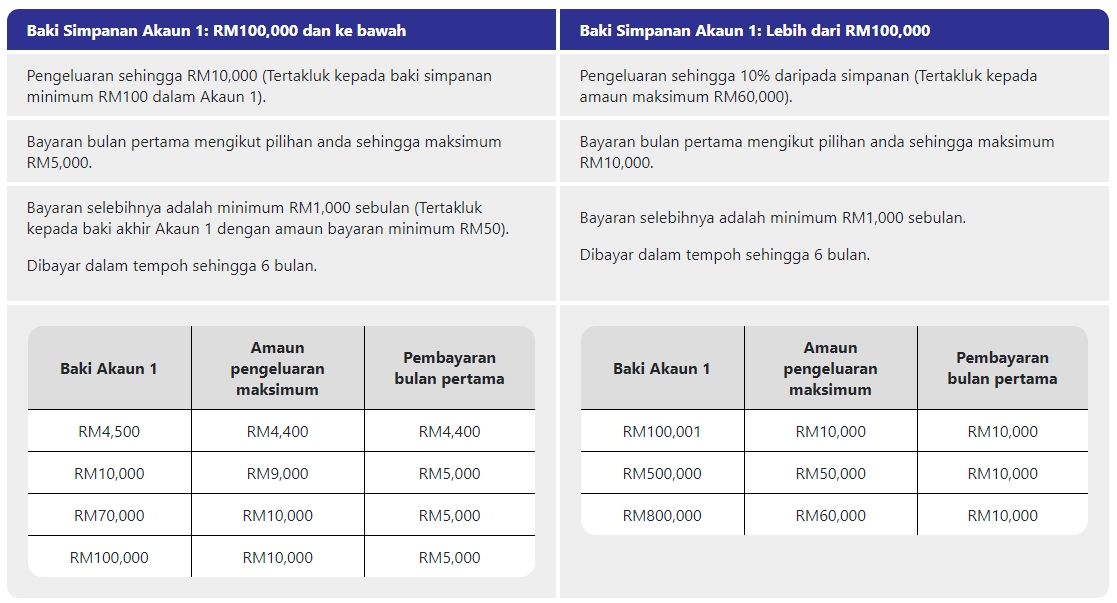

Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 - you can check via i-Account. Mohd Shahar Abdullah Twitter pic November 24 2021. At that time the entire balance in the EPF account can be withdrawn by the employee.

This whole idea of withdrawing from Account 1 is a bad idea. But now account holder will have to wait till attaining the age of 57 years to withdraw 90 of the accumulated balance. Online filing of transfer claim from previous account to new EPF account in case of job change from one covered EPF establishment to another EPF Covered establishment.

Here are the main amendments to EPF withdrawal rules-. I have written a post on this by sharing the EPFO notification. Member can effect transfer of EPF Fund from previous account to new account without transfer claim if both account is linked with UAN and Aadhar seeded.

EPF members with Account 1 balances greater than MYR 100000 can. If you want to know what else you can do with your EPF monies read. The retirement age for EPF is 55 years.

Monthly contributions between the age of 55 60 will be allocated under this account. The EPF assures members that no such steps on raising the withdrawal age. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of.

Withdraw via i-Akaun plan ahead for your retirement. Earlier a withdrawal was allowed up to 90 of the EPF balance one year prior to retirement ie. You can refer the same at Interest on Inoperative EPF Accounts up to 58 Yrs of age.

In the first payment up to MYR 5000 will be given over a six month period. If you have online EPF i-account you also can check the allowable withdrawal amount under Withdrawal menu or to be precise Withdrawal Eligibility menu.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55 Asset Display Page

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Tidak ada komentar:

Posting Komentar