Owing to the difficult times that the country is going through the government has allowed individuals to partially withdraw their EPF corpus in order to survive the crisis. Here is how to withdraw PF online.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

The i-Citra withdrawal was introduced following the announcement of the Pakej Perlindungan Rakyat dan Pemulihan Ekonomi Pemulih by Prime Minister Tan Sri Muhyiddin Yassin on 28 June 2021 as a temporary relief measure to help EPF members tide over the economic impact from the COVID-19 pandemic balancing todays demands against future needs.

Epf withdrawal covid. Covid 19 PF Withdrawal Time Period- Since COVID-19 has been declared a Pandemic by the Appropriate Government for the entire country and therefore the employees working in establishments and factories across entire India who are members of the EPF Scheme 1952 are eligible. EPF Chairman Tan Sri Ahmad Badri Mohd Zahir. EPFO allows members second Covid advance withdrawal.

- frequently asked questions on epf advance to fight covid-19 pandemic dated 26 apr 2020 - Consolidated Guidelines of Ministry of Home Affairs for Containment of COVID-19 reg - Extension of due date for payment of contributions and administrative chargesInspection charges due for wage month march 2020 from 15042020 to 15052020 to establishments disbursing wages for March 2020. In order for members to recover the amount lost from Covid-19-related withdrawals they would have to work for an additional four to six years. For those with RM100000 and below in Account 1 they can withdraw any amount up to RM10000.

All new Employees Provident Fund EPF contributions of members who had made withdrawals to weather the economic effects due to Covid-19 will be credited into Account 1. The facility of EPF withdrawal and obtaining a non-refundable advance is to help employees in need of money amidst the COVID-19 lockdown. Go to Unified Member Portal ie.

How to withdraw money from EPF due to covid-19. As per EPF withdrawal rules a member can withdraw an amount equal to three months of basic salary and dearness allowance DA or 75 of the credit balance in the account whichever is lower. Considering the COVID-19 pandemic or similar situations when there might a lockdown in the entire country EPFO has allowed withdrawal of EPF if an employee faces unemployment before retirement due to lockdown or retrenchment.

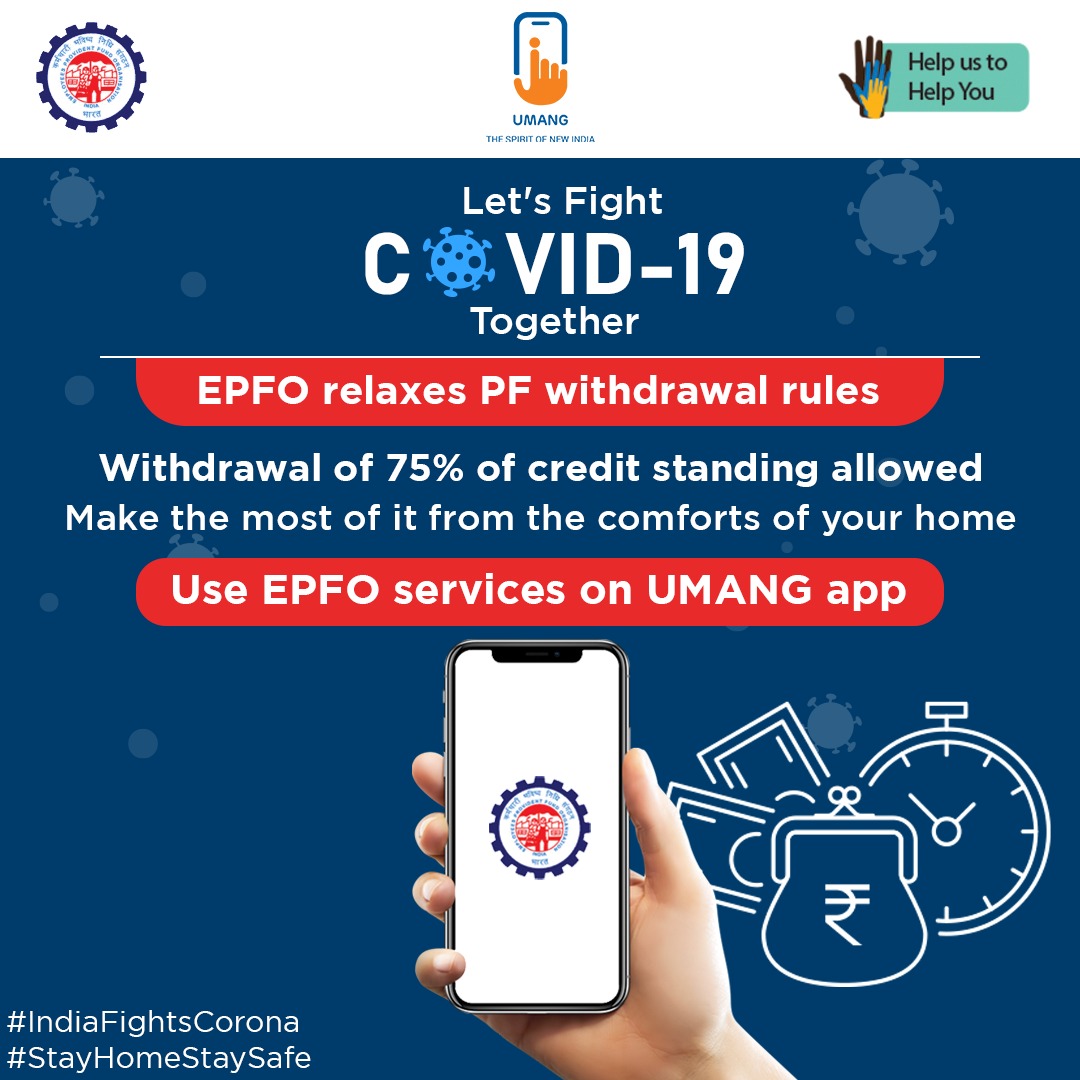

In May this year EPFO allowed its members to avail a second non-refundable Covid-19 advance to support its subscribers during the second wave of. The provision to withdraw money from EPF accounts was first announced last year in March 2020 under Pradhan Mantri Garib Kalyan Yojana PMGKY. Members of the Employees Provident Fund Organisation EPFO can avail various EPFO services on the UMANG App.

Replenish EPF funds withdrawn under Covid-19 packages. An EPF withdrawal is tax-exempt only if the employee renders a continuous service for five years. The Employees Provident Fund EPF has expressed concern that the majority of its members are now at risk of falling into old-age poverty as Covid-19.

At the time of writing on Monday the EPF had not issued a statement in response to NUBEs statement. EPFO members can withdraw PF amount via UMANG App. UMANG App can even be used by members to withdraw their EPF money from their Provident Fund PF account.

During the second wave of Covid-19 pandemic mucormycosis or black fungus has been declared an epidemic recently. Employees can withdraw 90 of their EPF corpus before 1 year of their retirement. Earlier only a one-time advance was available for EPF members.

Almost half of EPF members below the age of 55 have critically low savings because of. As part of Covid-19 relief efforts the government allowed subscribers of the Employees Provident Fund EPF to partially withdraw funds from their accounts. For those who have above RM100000 in Account 1 they can withdraw a maximum 10 of their Account 1 savings up to RM60000 whichever is lower.

According to the new regulation an EPFO subscriber is allowed for a PF withdrawal of three months basic salary Dearness Allowance DA or 75 of the gross PF amount whichever is lower. The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be withdrawn in part or in whole. You can get non-refundable withdrawal to the extent of the basic wages and dearness allowances for three months or up to 75 of.

Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000. Withdrawals from EPF during Covid-19. Httpsunifiedportal-memepfindiagovinmemberinterface and log in with UAN.

KUALA LUMPUR The Employees Provident Fund EPF has expressed concern that the majority of its members are now at risk of falling into old-age poverty as COVID-19 related withdrawals have caused insufficient savings to live out a dignified retirement life. Ahmad Badri said the median savings of EPF members at the age of 54 at RM38000 means that retirees can spend up to RM159 per month for the next 20 years. To help members with the withdrawal process on April 26 2020 the EPFO issued a set of FAQs.

Click on the Manage tab and select KYC to. As on date EPFO has settled more than 7631 lakh COVID-19 advance claims thereby disbursing a total of Rs. Employees are given the option of using their EPF savings to meet their financial needs.

The National Union of Bank Employees Nube has urged the Employees Provident Fund EPF board to. The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva. An employee can withdraw six times the monthly salary or employees share with interest whichever amount is lesser from the EPF for medical treatment including that of Covid.

The Employees Provident Fund Organization EPFO has helped account holders by easing the EPF withdrawal norms during the COVID-19 pandemicActually the Narendra Modi Government amended the EPFO withdrawal rules allowing the EPF account holders to go for partial EPF withdrawal in order to get money during lockdown when they would have run short. In such trying times EPFO endeavours to lend a helping hand to its members by meeting their financial needs. EPF members were allowed to withdraw upto 75 of their provident fund balance if faced with financial stress due to Covid-19 pandemic.

Payments will be staggered over. Under the relaxation members are allowed to withdraw either 75 of their funds or three. Covid-19 withdrawals compound issue of insufficient retirement savings.

Steps for withdrawing the second COVID advance through online mode are as follows. However in a case where a facility of advance is provided due to a. The EPFO has operationalised this withdrawal and named it non-refundable advance.

The EPF had however said in a statement on Oct 31 2021 that following the special withdrawal facilities due to the Covid-19 pandemic the EPF is now focused on assisting members to rebuild their savings for their retirement future. Old-age poverty a big threat after Covid-19 withdrawals says EPF. If you are.

Epfo Covid 19 Specific Process To Claim Pf Advance Indiafightscorona Epfo Stayhomestaysafe Socialsecurity Facebook

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epfo Application For Epf Withdrawal Claims Form 31 Under Outbreak Of Pandemic Covid 19 Are Being Processed On Priority By Epfo Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Stayhomestaysafe Facebook

Mygovindia On Twitter Due To Covid 19 The Government Has Amended The Employees Provident Fund Withdrawal Rules Allowing Subscribers To Withdraw 75 Of The Credit Standing In Their Epf Account Or Three Months

Epfo File Epf Withdrawal Claim Under Covid 19 Category And Get 75 Of Epf Balance Or 3 Months Of Basic Wages Da Whichever Is Less Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Facebook

Tidak ada komentar:

Posting Komentar